*This page is only available in English

HANNON Customs Portal

The Customs Portal is available to all customers. The portal is designed to allow you to easily submit the new customs information required to accompany your Route 1, 2 & 3 consignments from 01 January 2021.

Route 1 – ROI/NI to mainland EU via GB (Transit)

Route 2 – EU (including ROI) to and from GB (EU exports and imports)

Route 3 – NI to and from GB via ROI (Transit)

We are providing you access to the Customs Portal in test mode. You can use the Customs Portal while it is in test mode before it goes fully live.

We would encourage you to log into the Customs Portal and to submit as many test consignments as you can to familiarise yourself with how the new system works. Any data entered while in test mode will NOT create any live jobs. The test mode is purely to allow you to get to know the new system.

The system will remain in test mode until midnight on Wednesday, 30 December 2020. After Wednesday, 30 December 2020 ALL test data will be removed and we will contact you again to confirm when the system has been set as fully operational.

Included below are videos which provide a step-by-step guide on the new processes and arrangements and outline how, when and what customs information you will need to provide from 1 January 2021.

Please take the time to watch your appropriate webinar as it will answer the vast majority of questions you may have.

If you are having difficulty logging onto the Customs Portal please contact brexit@hannontransport.com (Tel: +44 (0)28 94 548099) and they will be happy to help.

Customs Administration Team

Hannon Transport Ltd

Tel: +44 (0)28 94 548099

www.hannontransport.com

Simplified Transit Process

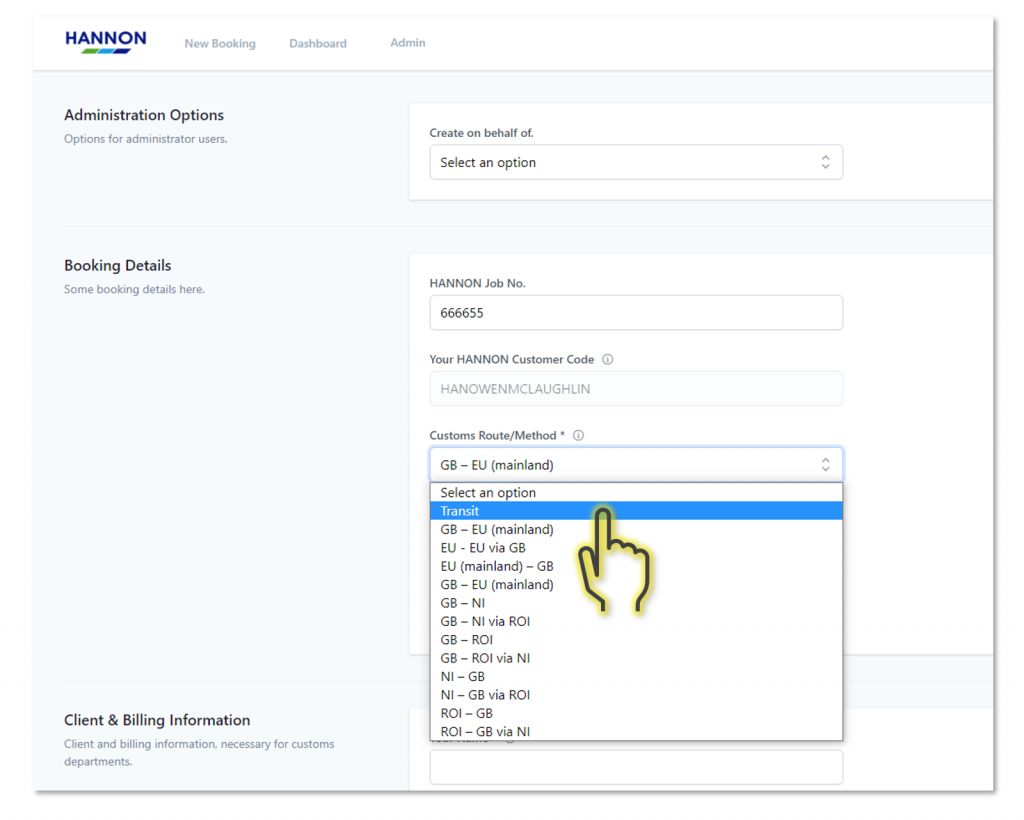

The Customs Portal includes a simplified process for movements between the island of Ireland and mainland EU via the GB landbridge. Simply selecting the Transit option in the Customs Route/Method field at the start of the process removes additional fields such as EORI details and Incoterms.

Watch the Webinar

Our Customs Administration Team have created webinar content which explains the new processes in detail. Videos of the webinars are included below.

Please take the time to watch your appropriate webinar as it will answer the vast majority of questions you may have.

Please ensure that you watch the webinar that relates to your transport requirements.

Movements ROI NI to GB

Goods Transiting GB

Appointing Hannon as a Customs Agent

Appointing Hannon as a Customs Agent

HANNON Transport can act as a customs agent on your behalf, but you need to provide us with a Letter of Authority (LOA) to do so.

Download a Letter of Authority. Once completed, please sign, scan and forward a copy to brexit@hannontransport.com

Phytosanitary shipments from GB to Ireland & Northern Ireland.

Possible new procedures in the event of a no-deal scenario.

We have created a customer advice sheet which provides specific advice and useful contacts to find out more. It is important that you download and read the customer advice we have provide

HANNON Customs Portal

HANNON Customs Portal

HANNON Transport has a new portal available to customers which will allow you to easily submit your consignments online and we can take care of the customs arrangements on your behalf.

We will be emailing customers week commencing 14 December 2020 with details and login credentials for the Customs Portal. You should take the time to get your Commodity Codes organised.

Useful information

Useful information

Links to some other information that might be useful..

We need your EORI Numbers

We need your EORI Numbers

From 01 January 2021 you will need an EORI number to move goods between the island of Ireland (ROI & NI) and GB or to move goods between Great Britain (England, Scotland and Wales) and the EU. GB companies may also need an EORI Number if they move goods to or from Northern Ireland.

If you move goods to or from Northern Ireland, from 1 January 2021 you’ll need an EORI number that starts with XI

The deadline for auto-enrolment for an XI EORI number has been extended to 14 December. After this date, a manual process will be available.

Contact us

Contact us

We are here to help all our customers. Please feel free to contact the Customs Administration Team if you need any help or would like some more information. We will soon be in contact with customers again to start the roll out of our Online Customs Portal.

Fill out the Contact Form